Navigating the Peaks: Analyzing Record Highs in Financial Markets

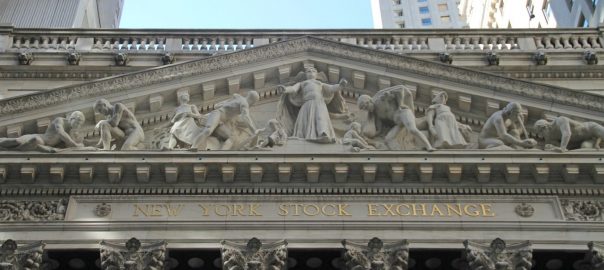

Stock markets continued rising in the second quarter, notwithstanding mounting concerns about inflation and dwindling hopes for a series of interest rate cuts before year-end. The US stock market has experienced overRead More…