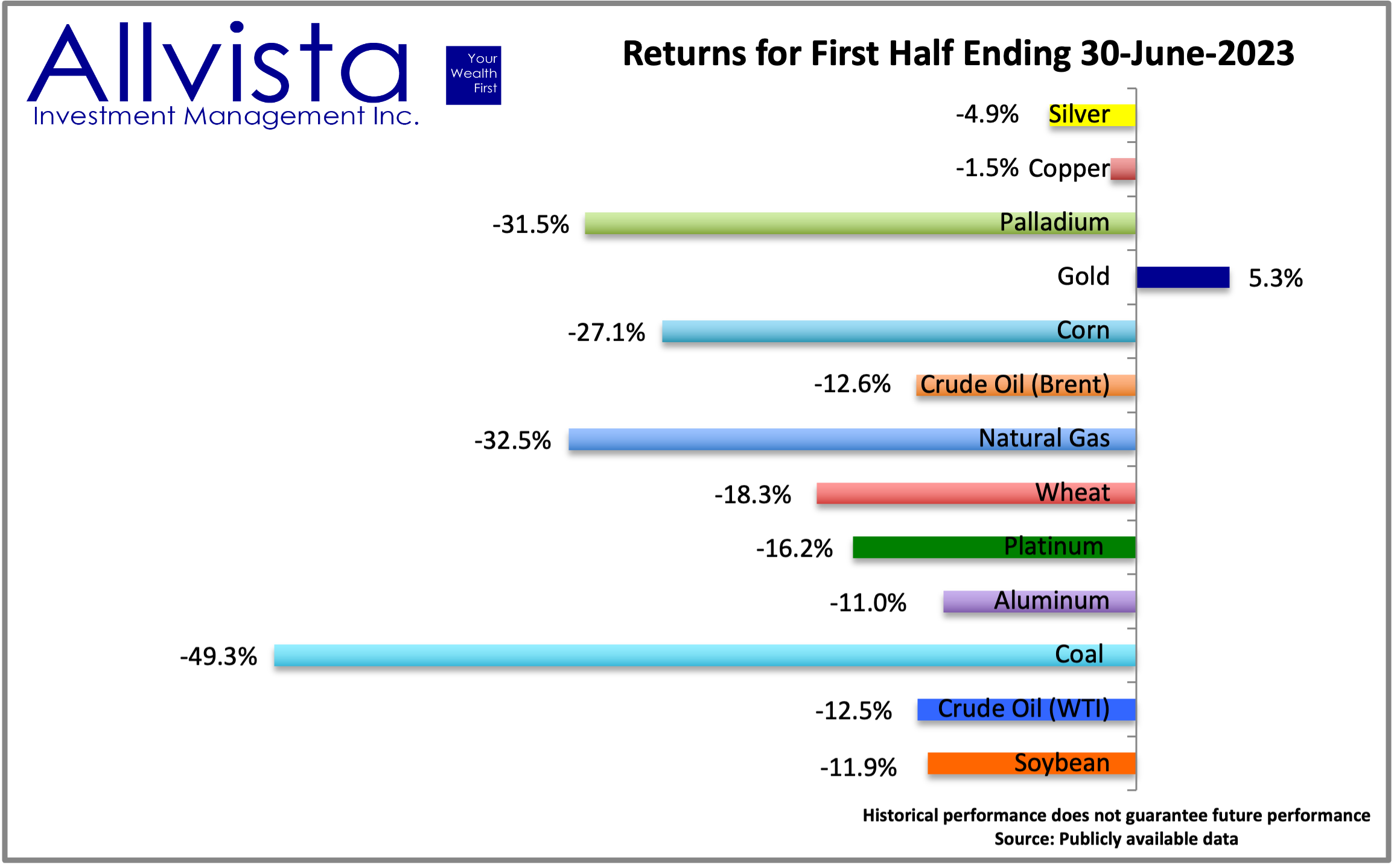

Recession Concerns Undermine Commodity Markets in First Half

Ongoing fears of a recession, which has yet to come, cast a pall over commodity markets during the first half of the year, with few managing to gain new ground. Coal and natural gas were hardest hit as the shift to fossil-free energy sources gained further momentum. Palladium also suffered. Oil prices shrugged off surprise OPEC production cuts and languished around $75 – $10 lower than the beginning of the year.

Grain prices fell as planting conditions improved and supply picked up ahead of demand. However, Russia’s withdrawal from the Black Sea Grain Deal after it expired has introduced a great deal of uncertainty about the outlook for these soft commodities, with wheat, grain and soybean prices jumping higher in the wake of the news.

Crude Oil WTI (down 12.3% YTD) & Brent Crude (down 12.4% YTD) – One of the major drivers of the downward trend in oil prices is a deterioration in economic sentiment, especially in the U.S. More and more analysts are expecting a recession within the next year and the jury is still out on whether this will be a mild recession or a hard landing for the global economy. Higher interest rates have seen inflation rates coming off, though core inflation remains sticky and a slower-than-expected recovery in the Chinese economy, particularly, manufacturing, consumption and the property market is expected to dampen demand.

Despite OPEC’s decision to cut production the downward trend in crude oil prices continued as analysts note that the market is being less driven by demand-supply fundamentals and more by macroeconomic concerns. The trend is expected to continue during the summer but an anticipated supply deficit in the second half of 2023 might reassert the role of supply and demand dynamics in determining the oil price, which could see it rally again.

Natural Gas (down 32.6% YTD) – One of the key factors contributing to natural gas prices declining by almost a third during the first half of the year has been the warmer weather in Europe and the U.S. this year, which led to people using less gas for heating purposes. High inventory levels in industries and lower demand for gas in power generation have also been weighing on natural gas futures. It is also possible that manufacturers are driving down industrial demand by delaying their purchases in anticipation of further reductions for their purchases.

Coal (down 49.3% YTD) – Rising coal exports from countries like South Africa and Colombia have increased the global supply of coal when demand has come under pressure due to climate considerations and the drive to move away from fossil fuels and toward renewable energy sources. That has resulted in a significant decline in the price of coal year to date. In addition, lower natural gas prices saw some users shift to gas, which also placed downward pressure on the coal price.

Metals

Silver (down 5.3% YTD) – Recession concerns led to a decline in silver prices as traders were concerned about low demand for the metal as an industrial input for goods with high electricity conduction needs. In addition, the metal has been facing a strong sell-off due to China’s economy running out of steam after a promising start to the year. Other contributing factors to the lower silver price include a higher US dollar index compared to the last couple of years, rising interest rates and the fear of individuals potentially adding to the precious metal’s demand deficit. However, the overall appetite for silver is expected to rise due to industrial needs as the world overcomes its macroeconomic challenges and continues to move away from fossil fuels.

Copper (down 1.8% YTD) – Copper has also been impacted by the recessionary fears of money managers who have been reducing exposure to commodities.

Moreover, in China, significant producers curtailed their copper imports. The International Copper Study Group reported a substantial 332,000-tonne surplus in the global refined copper market during the first quarter of this year, compared to a mere 8,000-tonne surplus in the same period last year. Several analysts have mentioned that the metal is pricing in a full recession in Western economies and could be in for a sharp upside correction if things turn out better than expected. Hence, low prices could provide an attractive long-term entry point.

Palladium (down 31.4% YTD) – Palladium is mainly used to neutralize harmful car emissions and thus rising demand for electric vehicles is threatening the demand for this precious metal. Even though the metal is expected to be in supply deficit this year, investors are highly concerned about the long-term headwinds posed by the growth of the electrical vehicle industry, with the same concerns attached to the outlook for Rhodium. In addition, automakers have been shifting from palladium to cheaper platinum to reduce carbon emissions in their exhaust systems.

Gold (up 5.2% YTD) – One of the main catalysts of this safe-haven precious metal include the outlook for interest rates, investors’ belief that inflation is coming down and that the Fed will pause hikes and begin cutting them sooner than anticipated. Gold historically has had a negative correlation to interest rates because other asset classes like bonds and money market funds are more attractive because of their higher yielding status. However, the precious metal’s safe haven status may come to the fore in the event of rising rates triggering recession and weighing down corporate earnings. Market sentiment is likely to turn to gold to defend against a potential stock market sell-off.

Platinum (down 15.7% YTD) – Platinum is facing short supply because of South Africa’s power crisis. The country accounts for 70% of the world’s platinum supply. Simultaneously demand for the metal is being buoyed by the automotive industry replacing expensive palladium for platinum in catalytic converters. The World Platinum Investment Council expects a 24% increase in demand for platinum in 2023 and highlights we are most likely entering a global, prolonged platinum deficit.

Aluminum (down 11.8% YTD) – The aluminum association released preliminary estimates for North American aluminum demand, which predicts it will decline 3.5% compared to last quarter. In addition, there is a decreasing demand from China, one of the major consumers of aluminum, as the economy fails to take off as anticipated. However, if the government does launch stimulus programmes to bolster growth in the second half of the year, the fortunes of the metal may turn for the better.

Grains

Corn (down 22.8% YTD) – USDA’s acreage report showed higher-than-expected corn acres and an overall surplus in supply were the contributing factors to the steep downward trend in the price of corn. In addition, expected rain in production areas, which would add to supply, drove the futures contracts even lower. In essence, bearish production estimate reports like the World Agricultural Supply and Demand Estimates provides an outlook of a demand deficit as corn supplies become easily available again.

Wheat (down 15.3% YTD) – Prices rose sharply in the early days of the Russia-Ukraine war, where disruptions threatened supply of this critical soft commodity. However, the trend reversed when Ukraine and Russia, supported by the United Nations and Turkey, agreed to the Black Sea Grain Deal corridor, which reopened up export flows halted by the war. The Joint Coordination Center (JCC) was put in place to facilitate exports for the region and the Deal allowed supplies, which had been trapped in the two countries as a result of the war, to re-enter the world market.

During the first half of the year, the wheat price eased 37% in response to additional supplies coming to market and easing concerns about supplies emanating from the war-torn region. However, Russia’s decision not to participate in the deal after it expired on June 17 saw wheat prices rise alongside concerns that world supplies of grains from the biggest grain-producing region would again be severely constrained.

Soybean (down 11.9% YTD) – Soybean prices jumped more than 5% higher after USDA lowered its 2023 acreage estimates to 83.5 million acres (down 5% from 2022). A flash sale to China and lower-than-expected stocks added to June’s bullish sentiment. Overall, in the year, soybean prices have also been influenced by new suppliers from Brazil and concerns of African swine fever spreading across Northern China and impacting pork production.

Looking forward

The outlook for the rest of the year will largely be determined by where interest rates end up going and whether the US Federal Reserve is able to pull off a soft landing. Also, a crucial determinant of whether commodities continue weakening or not will be how China’s policymakers get the economy going again. So far stimulus measures have been targeted but underwhelming. However, market participants are expecting bolder stimulus in the face of still weaker economic data and the threat of deflation.

Garnet O. Powell, MBA, CFA is the President & CEO of Allvista Investment Management Inc., a firm with a dedicated team of investment professionals that manage investment portfolios on behalf of individuals, corporations, and trusts to help them reach their investment goals. He has more than 25 years of experience in the financial markets and investing. He is also the Editor-in-Chief of the Canadian Wealth Advisors Network (CWAN) magazine. He can be reached at gpowell@allvista.ca