I view investing as successive days of exercising patience over the long term. This definition encapsulates the essence of prudent wealth accumulation. At its core, investing involves the

commitment to enduring market fluctuations, resisting short-term impulses, and maintaining a single-minded focus on long-term objectives. This description of investing underscores the importance of patience, a virtue often overshadowed by the allure of quick gains or the fear of temporary downturns.

In the realm of investing, success should be viewed as the ability to adhere to a disciplined strategy despite short-term fluctuations rather than a fixation on immediate outcomes. Patience allows investors to weather market volatility, capitalize on compounding returns, and remain aligned with their financial goals over time.

Furthermore, the concept of successive days implies a continuous journey, highlighting that investing is not a one-time event but a lifelong endeavour. It underscores the need for consistency and perseverance, as each day presents new opportunities and challenges that require ongoing commitment.

Ultimately, this definition serves as a poignant reminder that investing is a marathon, not a sprint. By embracing patience and focusing on the long term, investors can navigate the complexities of the market with resilience and achieve their financial aspirations.

These investment truths may seem unnecessary when markets are going up, as have been the case for the developed markets over the most recent period. With the US market seemingly on a never-ending sprint to new highs, it’s hard to envisage the downturns experienced during more challenging times. Though the global financial crisis and the Covid-induced sudden selloffs are relatively recent in historical terms, the subsequent bull market has seen investor sentiment continue to ride high.

The US S&P 500 Index achieved 22 new record highs in the first quarter of the year, closing the quarter 10% ahead. The extent of the rally since the stock market’s October lows is highlighted in the fact that the market value of the index participants has increased by $9 trillion.

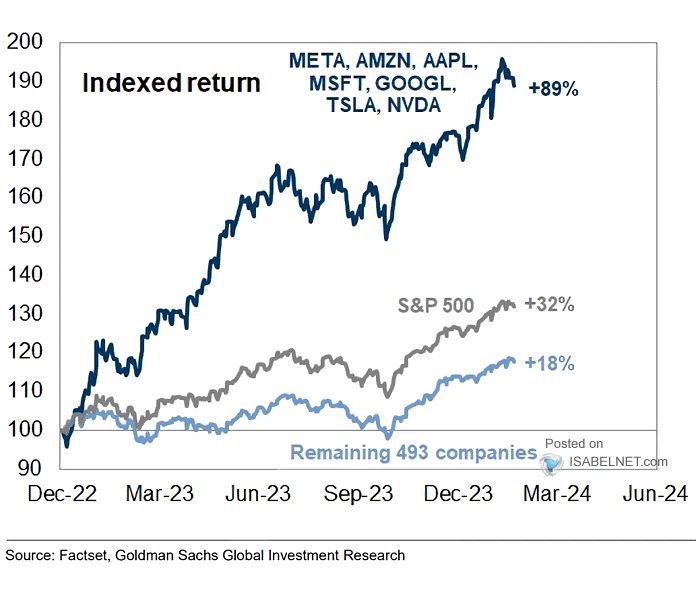

These gains could be mainly attributed to the ascent of the Magnificent Seven big tech stocks after the release of ChatGPT. This AI-enabled technology platform stimulated investor exuberance on the expectation that anything AI would benefit from this game-changing technology in the years ahead. The magnificent 7 are still leading the way and have been responsible for an outsized share of market returns. Japan’s stock market also made standout gains in the first quarter of the year, with the Nikkei bouncing back from the depths of despair experienced after the 1980 stock bubble burst. Signs of returning inflation have resulted in Japan ending its era of negative rates, and looser monetary policy has increased confidence in the manufacturing and service sectors. According to Investec, the Japanese equity market now represents good relative value, especially compared to US equities. It notes that the market’s buoyancy is likely to be underpinned by the Japanese corporate sector becoming the largest net buyer of its own stocks.

Japan’s stock market also made standout gains in the first quarter of the year, with the Nikkei bouncing back from the depths of despair experienced after the 1980 stock bubble burst. Signs of returning inflation have resulted in Japan ending its era of negative rates, and looser monetary policy has increased confidence in the manufacturing and service sectors. According to Investec, the Japanese equity market now represents good relative value, especially compared to US equities. It notes that the market’s buoyancy is likely to be underpinned by the Japanese corporate sector becoming the largest net buyer of its own stocks.

With many global stock markets near all-time highs, investors risk becoming over-zealous, already having jumped into speculative ventures in crypto and AI. Bitcoin ended the quarter almost 60% higher at $71,000 USD from about $45,000 USD at the start of the year. Nvidia, the company that has benefited most from the AI excitement because it provides the world with most of its high-powered chips, has gained 90% in the first quarter and is trading at a sky-high valuation: a price-to-earnings ratio of 75 times.

While all this is happening, many traditional high-quality companies are being ignored, which could present opportunities for disciplined long-term investors.

We don’t encourage clients to invest in Bitcoin because of several reasons. First, we don’t know who invented it. It is also not a viable means of exchange and does not generate any income. Even though the US Securities and Exchange Commission (SEC) has approved the trading of ETFs that track Bitcoin, there are too many government and regulatory concerns globally. Interestingly, the European Central Bank has issued a strong critique of the SEC’s approval, saying that Bitcoin has not lived up to the promise of becoming a global decentralized digital currency.

Recent price action in the cryptocurrency highlights growing concern that the Bitcoin rally may have turned into a speculative bubble. The Bitcoin price fell below $66,500 in Asian trade at the start of April after US Factory activity unexpectedly increased in March, signaling a still robust US economy.

In contrast, the office real estate sector remains in the doldrums, with the outlook gloomy. In January this year, commercial real estate and investment firm CBRE data showed that Canada’s national downtown office vacancy rate had hit a record high of 19.4% at the end of 2023, compared with a “healthy” rate of between 10% and 12%. In the US, where the office property market is similarly under pressure, vacancies rose to 17.9% in February, almost 1.5 percentage points from last year.

The landscape of Canada’s office real estate sector is undergoing a notable transformation, with fundamental shifts in risk perception and investor behavior reshaping the market’s dynamics. Previously viewed as a stable, low-risk investment, office properties face scrutiny amid prolonged hybrid work arrangements and technological disruptions. This reassessment prompts stakeholders to reevaluate the value proposition of office assets compared to alternative investments, leading to a divergence in investor preferences and a decrease in traditional institutional involvement.

Moreover, the sector is witnessing significant impacts stemming from variations in property quality and demographic trends. High-quality office buildings continue to demonstrate resilience, experiencing steady rent growth and robust demand, while lower-tier properties face increasing vacancies and uncertainty regarding their future use. Concurrently, Canada’s demographic landscape, marked by record immigration, challenges assumptions about remote work’s long-term dominance, potentially bolstering demand for office spaces. However, these shifts occur against a backdrop of rising inventories and declining new construction activity, as the completion of pre-pandemic mega-projects exacerbates vacancy rates and dampens prospects for future office tower development.

Meanwhile, Brookfield Asset Management recently described the US as the most oversupplied office market in the world, with property owners taking on too much debt and vacancy rates much higher than in Europe.

Trouble is also brewing in private credit markets, which were supposed to be safe investments, providing investors with steady coupons that were viewed as “guaranteeing” them a steady stream of payments. The market is showing signs of cracks, with funds managing nearly $10 billion in debt struggling with higher-than-usual redemption requests and grappling with major defaults on unlisted debt issuances. Analysts warn that even sophisticated investors may not receive enough information to determine their risk exposure, with Cortland’s largest borrower filing for creditor protection and few investors knowing about that.

There are mounting concerns in the US that private credit firms may be overvaluing their assets and underestimating their loan default ratios. Data shows that loan defaults were valued at 48 cents on the dollar after a default, worse than the 55 cents recovered from loans by bank-led syndicates.

Much will depend on the outlook for interest rates this year. Home prices are still high, with the rise in interest rates, higher prices, and lack of supply converged to create an affordability crisis in Canada’s housing market. Crude oil prices have increased to five-month highs, highlighting that energy prices could still stand in the way of bringing inflation down to acceptable levels for central banks.

In the US, the Fed chair Jerome Powell has repeatedly indicated he needs to be sure that inflation is moving towards their 2% target before reducing rates. The Fed is thus unlikely to start cutting rates until there is evidence that the economy is weakening, and right now, the economy is still looking quite strong.

Unemployment is low, and employers are hiring workers. There was a slight deterioration in the unemployment picture in February, prompting Powell to say that the central bank was ready to support the job market. The unemployment rate increased marginally to 3.9% in February from 3.7% the previous month. The concern is that an increase in unemployment can quickly gain momentum, with adverse consequences for the rest of the economy.

Most central banks were expected to begin reducing rates from mid-year. Investor expectations on the extent of the rate cuts were becoming more aligned with the central banks’ own guidance, with financial markets recently pricing in three rate cuts versus the six rate cuts priced in at the beginning of the year.

While the prevailing storyline has been that interest rate cuts are coming this year, and investors have been on the edge of their seats about when exactly these cuts are coming, any indication that rate cuts might be delayed could stoke market anxiety. This is precisely what happened recently when Neel Kashkari, a Federal Reserve official, suggested that interest rate cuts might not occur in 2024. This development, along with spiking oil prices, may dampen the extreme exuberance witnessed so far this year and eventually lead to further market unease.

In fact, the March 19-20 Federal Reserve meeting minutes reveal concerns about stalled progress on inflation and the potential need for prolonged tight monetary policy to curb price increases. Uncertainty persists regarding inflation’s persistence at 2%, with recent data showing unexpected inflation spikes. Debates within the Fed focus on the risk of policy remaining too tight or easing prematurely. While some officials anticipate slowing housing inflation and sustained economic growth, there’s a general apprehension about the ongoing inflation battle. Despite strong economic momentum, disappointing inflation readings prompt caution in rate cuts.

Nonetheless, the Swiss central bank broke ranks in March, becoming the first major central bank to reduce its official interest rates by 25 basis points to 1.5%. The Bank of England may soon follow, with economist and market analysts speculating that the bank may cut rates as early as May. In Canada, policy makers are concerned about low productivity. The Bank of Canada attributes the country’s lacklustre growth compared with the US’s to a lack of competition and mismatched job skills.

This week the Bank of Canada maintained its benchmark interest rate at 5%, citing a potential rate cut in June if sustained progress on inflation is observed. Governor Tiff Macklem noted a decline in inflation and expressed optimism about reaching the 2% target. While recent data hinted at a possible rate cut, policymakers seek prolonged evidence of inflation easing. The bank anticipates CPI around 3% due to rising gas prices but expects gradual core inflation decline.

The post-pandemic investment landscape is still clouded by uncertainty, in large part driven by the massive amount of stimulus and liquidity that was pumped into the global financial system in the wake of the 2008 crisis and the ongoing effort to unwind that stimulus due to the inflationary and speculative effects it has caused. At this juncture, it is even more imperative to follow a disciplined investment strategy to meet your retirement goals.

Garnet O. Powell, MBA, CFA is the President & CEO of Allvista Investment Management Inc., a firm with a dedicated team of investment professionals that manage investment portfolios on behalf of individuals, corporations, and trusts to help them reach their investment goals. He has more than 25 years of experience in the financial markets and investing. He is also the Editor-in-Chief of the Canadian Wealth Advisors Network (CWAN) magazine. He can be reached at gpowell@allvista.ca