Global Commodities Market Performance and Growth Trends in 2023

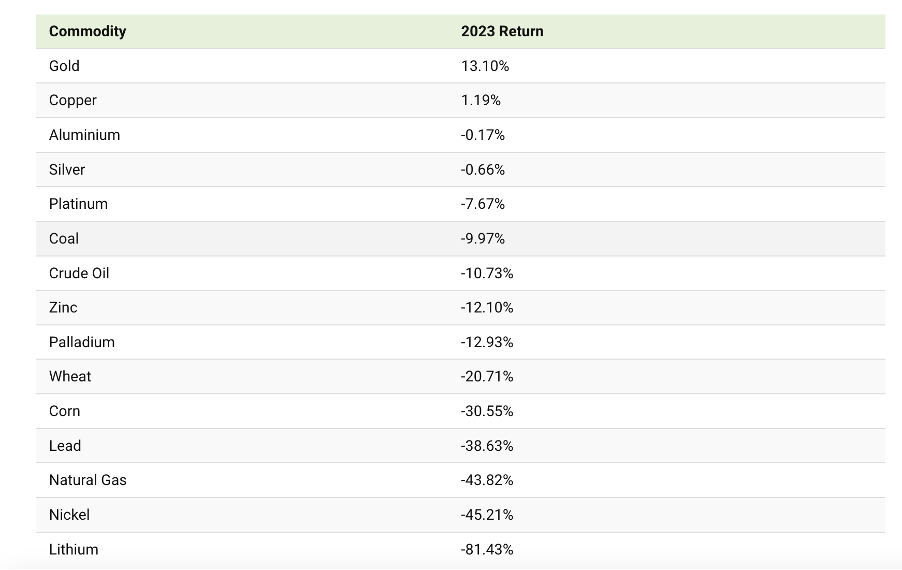

Lacklustre demand and ample and, in some cases, oversupply meant it was a tough year for the lion’s share of the commodity basket in 2023. Gold and copper were the only metals to end the year in positive territory, with gold up 13.1% and copper eking out a 1.2% gain.

The worst performers were Lithium (down 81.43%), Nickel (45.2%), and Natural Gas (43.8%), all of which were impacted by oversupply and less demand than expected at the beginning of the year.

Commodity price trends tell us a lot about what’s going on in the global economy, and thus, it’s worth keeping abreast of developments. For instance, lithium’s price was decimated because supplies were so robust and projected to increase to 30000 metric tons globally this year. At the other end of the scale, gold benefited from the dollar’s weakness and geopolitical instability, pushing the precious metal to a record high of $2,135 an ounce in December.

In this article, we will review the performance of commodities across the spectrum, including soft agricultural commodities, and identify those expected to benefit most from strong demand in the years ahead.

Overview of Main Global Commodities Markets in 2023

Several factors cast a pall over the commodities market during 2023. These include rising rates, expectations that advanced countries would experience a recession, and China’s growth proving much less robust after the pandemic.

The Bloomberg Commodity Index gives you a bird’s eye view of the 24 commodities it tracks, and it fell 12% during the year. Meanwhile, the Bloomberg Energy Index experienced its largest annual decline since 2018, losing 24% – double the headline index’s losses.

Surprisingly, the impact of Israel’s attack on Gaza on commodities like oil and grain has proved limited, but the war is seen as a major geopolitical risk, particularly if it spreads further across the Middle East. Houthi rebel attacks on container ships traveling across the Red Sea and the US’s decisive response suggest there may be more hostility to come.

OPEC+ production cuts failed to move the needle on the oil price, with Brent crude oil coming off 10% during the year on weak demand from China, the world’s second-largest oil consumer, and soaring US production.

Gold benefited from its safe haven status but also, arguably more importantly, from central banks increasing the gold reserves during the year as the momentum behind toppling the dollar as the reserve currency of the world grows.

Silver ended the year slightly in the red, but prospects look much more promising for the precious metal in 2024 as it is indispensable in producing photovoltaics and electronics and is a core component of other industrial applications.

Notwithstanding the significant investments in the green energy transition, copper had a pedestrian year, rising 1.2%, well below its early 2022 record high. Ample supplies and muted demand from China contributed to its muted performance.

The copper price is expected to remain under pressure as long as interest rates remain high, the dollar strong, and Chinese demand weak. From a longer-term perspective, however, the International Energy Agency estimates that existing copper production and mines under construction will meet 80% of the world’s climate goal requirements by the end of the decade.

Soft commodities also came off sharply during 2023 on supply well-exceeding demand. Wheat prices fell more than 20%, and corn prices by more than 30%. This came as somewhat a surprise to some commodity analysts who believed that grain prices would be supported by the ongoing Ukraine-Russia war, given the region’s importance in world supplies. However, supplies were bolstered by bigger North and South American harvests due to better weather and slower demand than expected.

Commodities with the Fastest Growing Demand

Commodity price cycles are predominantly driven by high demand, with China a central cog in the wheel as the world’s largest consumer of commodities over the past two decades. However, demand has largely been absent from the commodity market over the past year as China has grappled with its structural problems and disappointing rebound after the country emerged from Covid and initially rebounded strongly before its economic momentum ran out of steam and the indebtedness of the property market came to the fore.

In 2024, demand is expected to remain anemic for most commodities, with precious metals and uranium the only resources expected to benefit from buoyant demand and a favorable demand-supply balance during 2024.

Gold and silver are viewed as most likely to come in at the top of the commodity leaderboard, seeing particularly bullish demand in the second half of the year when they ride high on the anticipated interest rate cuts in the US and other advanced economies.

Meanwhile, uranium is on the up as global investments in nuclear energy as an alternative to solar and wind gather pace.

Analysis of High-Demand Commodities

Gold

Demand for gold predominantly stemmed from central bank purchases and an appetite for the metal’s safe-haven investment qualities in the face of rising geopolitical risks arising out of Israel’s invasion of Gaza and the ongoing Russia-Ukraine war.

Central banks, like China, continued to buy gold in big quantities, shifting away from US assets in line with the bifurcation of global power underway and emerging markets’ growing desire to reduce their reliance on the US dollar as the world’s reserve currency. The World Gold Council estimates that central banks, including those in China, Poland and Singapore, bought 800 tonnes of gold by September last year – a number that is expected to increase to 950 for the year as a whole. Central bank demand for gold is expected to remain high in the years ahead as China continues to increase the proportion of gold in its reserves from still-low levels of around 4% compared with the 71% gold comprises of the US’s total reserves.

US Global Investors points out that if China were to reach America’s level, “it would need to buy an additional 33,810 metric tons, which is 10 times more gold than the entire world produced in 2022.”

Further demand for gold is expected to stem from the decline in Treasury yields that typically accompanies interest cuts. The Federal Reserve has indicated three cuts this year, but investors anticipate even more, providing a firm underpinning for the gold price.

In a recent research note, “Will gold prices hit another all-time high in 2024?” JP Morgan Head of Base and Precious Metals Strategy Gregory Shearer says: “We think over this period, the Fed cutting cycle and falling US real yields will once again become the mono-driver behind gold’s breakout rally later in 2024. Gold’s inverse relationship to real yields has historically been weaker over Fed hiking cycles, before strengthening again as yields fall over a transition into a cutting cycle”.

Investor and EFT demand for gold is also expected to rally this year, with JP Morgan pointing out that total ETF holdings in gold have fallen steadily since mid-2022, “so a re-lengthening of investor positioning (exchange and ETF) triggered by the onset of a cutting cycle is expected to be positive for bullion and supportive of a rally in prices in the second half of 2024.”

Silver

Demand for silver is expected to grow from both an investment and an industrial point of view during 2024. Silver’s attraction as a precious metal investment typically increases as Treasury yields come down in line with declining interest rates, which means the upside potential of the precious metal, which provides no income yield, becomes more attractive.

Industrial demand for the metal arising from the green transition is also set to propel its price higher. The precious metal plays a critical role in producing electronic goods, solar panels, and electric vehicles, which means industrial usage drives almost half the demand for silver versus the less than 10% industrial usage that contributes towards total gold demand.

JP Morgan is bullish on silver as well as gold’s prospects during 2024. While the silver price did rally alongside gold in December as investors got excited about likely rate reductions, it didn’t rise to the same record levels as gold. Thus, the precious metal is seen as offering a window of opportunity into the metal before prices experience an “explosive move” this year.

According to the Silver Institute, industrial demand, which is expected to reach a new high in 2023, amounting to a record 632 million ounces in 2023, is being propelled by investments in photovoltaics, power grids, 5G networks, consumer electronics, and rising vehicle output.

Other demand will come from the jewelry and photography industries.

Meanwhile, a deficit in silver supply contributes to the silver bull case, with Bank of America research suggesting silver supply peaked in 2016. In 2023, the supply deficit is expected to be 141 million and not likely to be alleviated soon.

Uranium

Demand for uranium is undergoing an about-turn as nuclear power gains traction globally. The World Nuclear Association predicts reactor demand will rise to almost 130,000 metric tons (MT) in 2040 from about 65 650 MT in 2023. Its data shows that about 440 reactors are operating worldwide, with 60 under construction and 110 planned. While most are in Asia, nuclear energy is expected to play a bigger role in the transition to fossil fuel energy because it counterbalances other intermittent energy sources, such as wind and solar, by always being on and, thus, more reliable.

Meanwhile, uranium is in short supply after producers cut back on production at lower uranium prices over the last few years. Russian supplies are also likely to be unavailable to countries like the US, which agreed to ban imports of enriched uranium last year. Supplies of uranium from Niger, the world’s seventh largest producer of uranium, are also at risk after the country experienced a military coup in August last year.

Given these favourable demand-supply dynamics for the heavy metal, analysts are highly bullish on the outlook for the price and expect a sustained and robust move higher in the price after it increased to more than $90 an MT last year from $50 at the start of the year. In January, the price increased further to more than $105 when, according to Trading Economics, “Kazakhstan’s state-owned Kazatomprom, the world’s largest uranium producer, stated it would be unable to meet its production target for the next two years amid a shortage in inputs and construction issues. This added to Canadian Cameco’s outlook downgrade in September due to issues in key mines.”

Factors Influencing Supply and Demand in Commodities Markets

Interest rates at 22-year highs and slower growth globally meant less demand for hard and soft commodities. China’s disappointing economic performance had a particularly meaningful impact on base metals and energy commodities.

Green transition metals had a surprisingly bad year based on a combination of oversupply after years of investment in mining these resources, given the demand outlook. However, a combination of disappointingly low demand for electric vehicles and the demand-supply imbalance of the metals central to the transition to a fossil-free future saw the bottom fall out of lithium prices, which tanked 80%, and nickel prices almost halve on the prospect of a 239 000 metric ton surplus in the metal in 2024. The longer-term outlook does appear more favorable for these metals, with the IEA foreseeing lithium meeting a mere half of the climate goal requirements by 2030.

Natural gas prices fell sharply on oversupply, too, with areas of the US experiencing record high gas production levels. According to S&P Global Commodity Insights, US dry natural gas production in the Lower 48 states (L48) reached an all-time monthly high of 104.9 billion cubic feet per day (Bcf/d) in November last year.

OPEC’s attempts to keep oil output in check by reducing production levels had little effect as demand proved weaker than expected due to slower Chinese global growth and advanced countries toying with recession during the year. Recent escalations in the Middle East, which have seen the Houthis attacking commercial shipments in the Red Sea, saw the oil price rise 8%, highlighting the potential impact of evolving geopolitical risks on crude oil in the oil-rich Middle East.

In the soft commodity complex, ample production due to better weather and slower demand meant wheat, corn, and soybean prices experienced steep declines.

Conclusion

It was a rough year for commodity investors as the impact of higher interest rates and slower growth was felt strongly in all but the precious metals and copper. Steep declines in lithium, nickel, and natural gas and double-digit losses in crude oil prices were surprising. Previous years had seen the prices of these commodities soar in the face of the green revolution with respect to lithium and nickel and the Russia-Ukraine war and the geopolitical threats it set in motion with respect to natural gas and oil.

Macroeconomic conditions are set to do an about-turn in 2024, with an anticipated reduction in interest rates set to change the landscape markedly. But geopolitical risks continue to loom large, suggesting the wise approach for investors is to remain cautious and agile because if the last few years have taught us anything, the future is uncertain and anything can happen.

Garnet O. Powell, MBA, CFA is the President & CEO of Allvista Investment Management Inc., a firm with a dedicated team of investment professionals that manage investment portfolios on behalf of individuals, corporations, and trusts to help them reach their investment goals. He has more than 25 years of experience in the financial markets and investing. He is also the Editor-in-Chief of the Canadian Wealth Advisors Network (CWAN) magazine. He can be reached at gpowell@allvista.ca

Disclaimer: The information provided in this commodities article is for informational purposes only and should not be construed as investment advice. Investing in commodities involves inherent risks, and the market for commodities can be highly volatile. The content of this article does not constitute a recommendation or endorsement of any specific commodity or company. Readers are strongly advised to conduct their own independent research and, where applicable, seek advice from a qualified financial professional before making any investment decisions. The past performance of commodities or companies mentioned in this article is not indicative of future results, and there is no guarantee that any investment strategy will be successful. The author and the publisher of this article do not accept any liability for any direct, indirect, or consequential loss or damage arising from the use of or reliance on the information provided herein. Investors should be aware of the risks involved in commodity investments and carefully consider their risk tolerance before making any financial decisions. It is crucial to stay informed about market conditions, conduct thorough due diligence, and, if necessary, consult with a financial advisor to assess the suitability of any investment strategy based on individual circumstances. The content of this article is subject to change without notice, and the author and publisher do not undertake any obligation to update or revise any information contained herein. In summary, readers are encouraged to exercise prudence, diligence, and caution when considering investments in commodities, and to make decisions based on their own financial goals and risk tolerance.