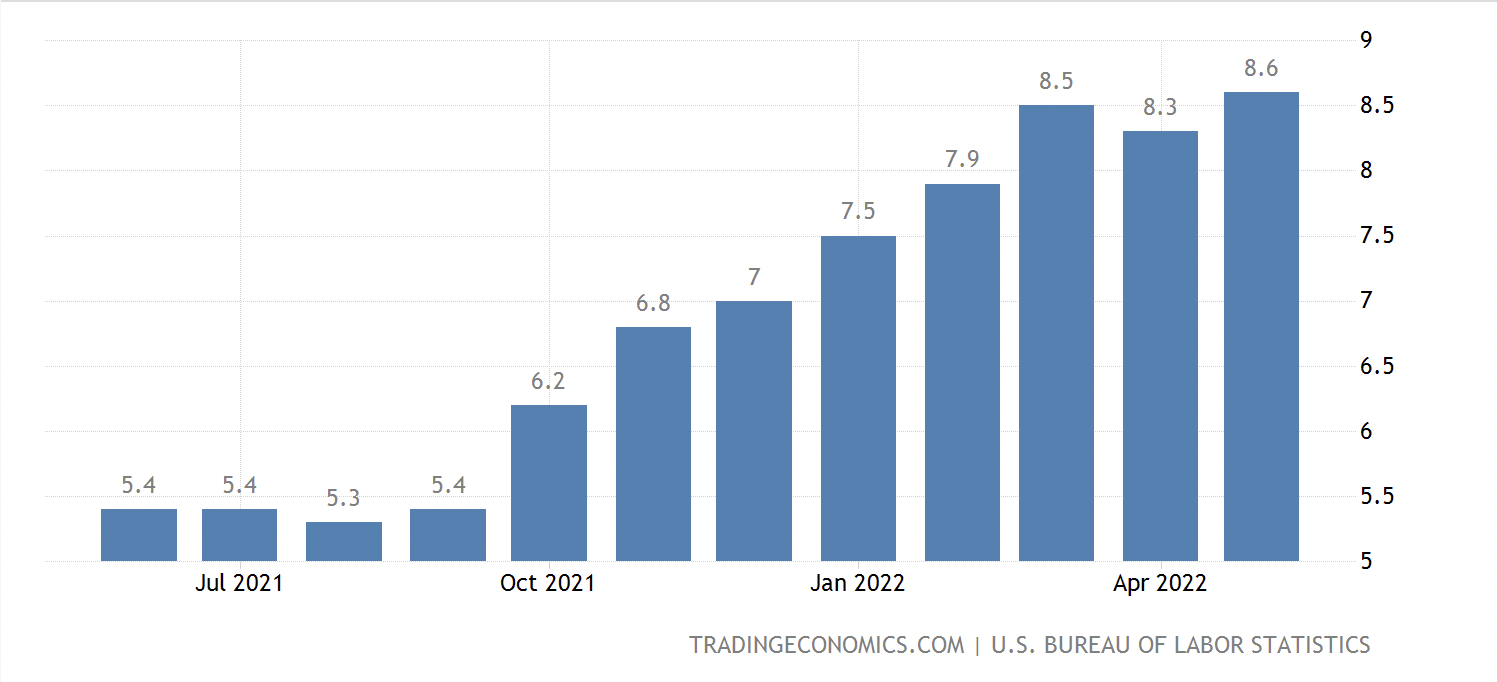

Financial markets have sold off dramatically in the face of so-called “monster” rate hikes, with the US Federal Reserve responding to a higher than expected May inflation rate with a 75-basis point rate hike.

US Annual Inflation Rate

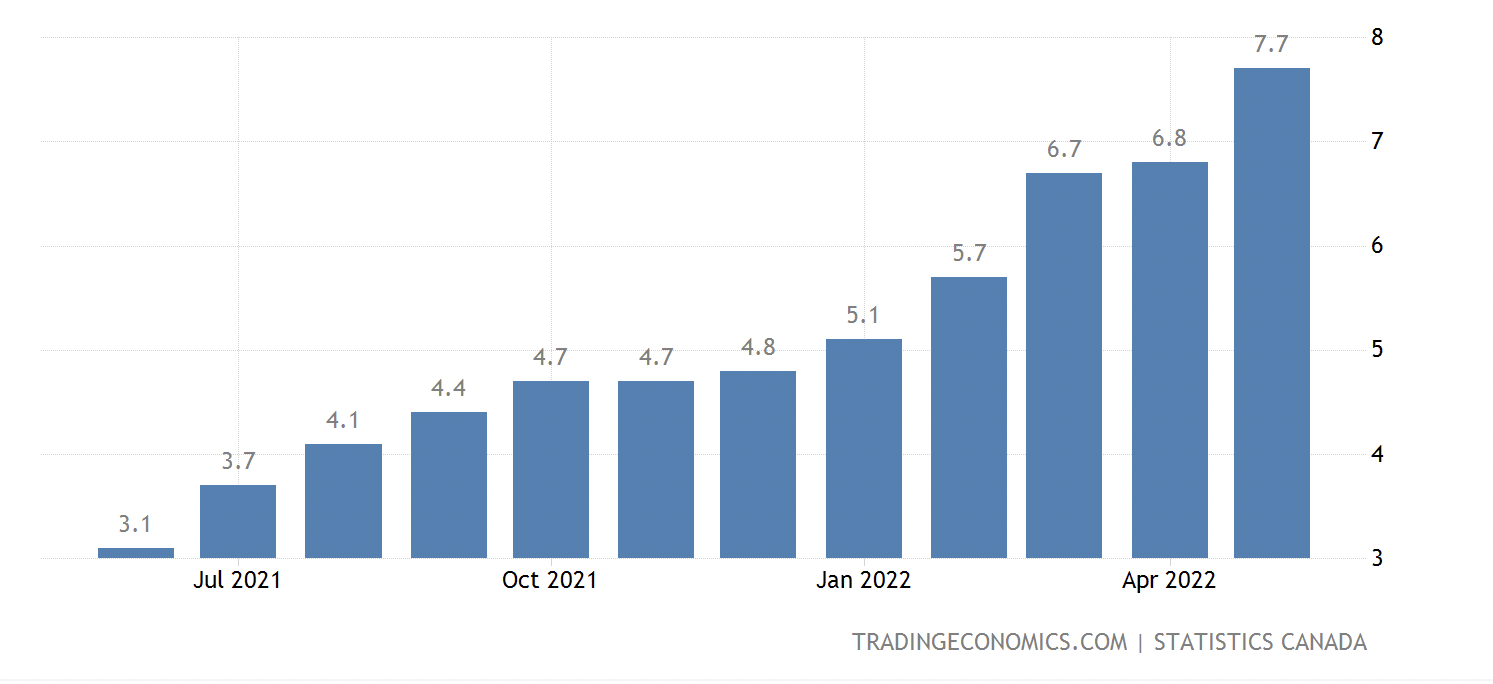

Canada Annual Inflation Rate

Stock markets experienced a temporary bounce in response after pricing in such a large interest rate move, and there is a strong possibility of another 75 bps hike to halt rising inflation expectations even though Fed chair Jerome Powell played down the likelihood at the central bank’s June meeting.

So far in June, the S&P 500 and Nasdaq have experienced double-digit losses, with hefty year-to-date losses of 23% and 31%, respectively. The Canadian S&P/TSX 60 has come off 8.5%.

The Fed hasn’t been alone in announcing outsize rate hikes this month. The Bank of Canada increased interest rates by 50bps in early June, Australia’s central bank by 50bps, the Bank of England by 25bps and the European Central Bank has indicated it will make its first 25bps hike at its next meeting.

The reason rates are rising is due to the prevalence of high inflation globally. In normal times central bankers will increase interest rates to prevent inflation from rising too high. In such an environment, there might be an abundant level of optimism and a general sense that the economy can handle higher rates. This is not the current reason for rates moving higher. The reason is an emergency situation to stop unprecedented levels of inflation and recent evidence showing that US inflation expectations, as measured by the University of Michigan, have shot up.

Higher rates could very well lead to jarring changes in asset valuations, but central bankers have limited options at their disposal to fix the inflation spiral. More worrying is that central bankers are not in control of key levers (such as supply chain and the war between Russia and the Ukraine) that impact the current level of inflation.

While there are still economists who expect inflation to slow in the second half of the year without causing a recession, this camp is shrinking fast. Walmart and Target’s recent financial results show these retail heavyweights have reported significant inventory stockpiles, which may have been built up due to concerns about supply-chain logjams and the ability to get goods to their shopfloors. These excess inventory levels could also be the result of consumers shifting demand from goods to services making it necessary for retailers to eventually discount, which would put downward pressure on prices. However, this all may be a sign of a weaker consumer, especially those in the middle and lower income brackets, which could mean trouble for the market and economy.

There are growing concerns that such significant monetary policy tightening will see developed market economies descend into recession and signal the onset of stagflation akin to that experienced in the 1970s. Thus central banks have an unenviable job of fighting inflation while engineering a soft landing.

At the onset of the pandemic, we wrote a post entitled: Investing Through a Coronavirus Plagued Economy. We outlined our investment philosophy and how we would position investors’ portfolios for a successful outcome, chiefly by investing in quality companies and avoiding the fad stocks that may temporarily benefit from a stay-at-home economy.

At the time, the major concern was the falloff in demand in many areas, but there were also supply issues in the areas where demand remained because of the lack of workers, shipping constraints, and stops and starts in manufacturing. Soon enough, these supply chain issues were exacerbated when demand picked up rapidly as economies reopened, buoyed by massive amounts of stimulus. These dynamics initially led to record inflation levels, which were exacerbated by the onset of the Ukraine-Russia war.

A key outcome of events over the past few years is that wealth inequality has intensified. Those who have financial assets have benefited from a tremendous increase in the price of those assets, and those who did not have investments have missed out in this wealth-creation process, driven by low rates and liquidity.

The goal now for those who have seen their assets increase in value is to hold on to those gains – a challenge when stock markets are proving exceptionally volatile in the face of concerns that stagflation may lie ahead. Speculation has also been rife as many investors have tried to ride the wave of increases in tech shares and crypto-assets. Unfortunately, some investors will only enjoy the experience of being briefly rich from the speculative gambits they have undertaken over the last few years.

The dream buyers have retreated, and some investors still holding on to assets that are a fraction of what they were worth at the peak of the cycle are left with a nightmare. One thing is for sure, the crop of speculators will dwindle – at least for a time until temptation lures them in once more and euphoria again takes grip of investors romanticizing about get-rich-quick schemes.

With the era of easy money quickly vanishing and growth slowing and possibly declining, too much optimism has clouded sound investment practices while the going was good, allowing many of these speculative ventures to put investors in a position where their capital is at risk of being destroyed.

The enormous volatility and significant sell-offs that have taken place as the central banks have upped the ante in withdrawing the liquidity that has underpinned asset valuations and announcing significant rate hikes, means cool heads need to prevail, and the focus should be on protecting capital while keeping the long-term in mind.

Garnet O. Powell, MBA, CFA is the President & CEO of Allvista Investment Management Inc., a firm with a dedicated team of investment professionals that manage investment portfolios on behalf of individuals, corporations, and trusts to help them reach their investment goals. He has more than 20 years of experience in the financial markets and investing. He is also the Editor-in-Chief of the Canadian Wealth Advisors Network (CWAN) magazine. He can be reached at gpowell@allvista.ca