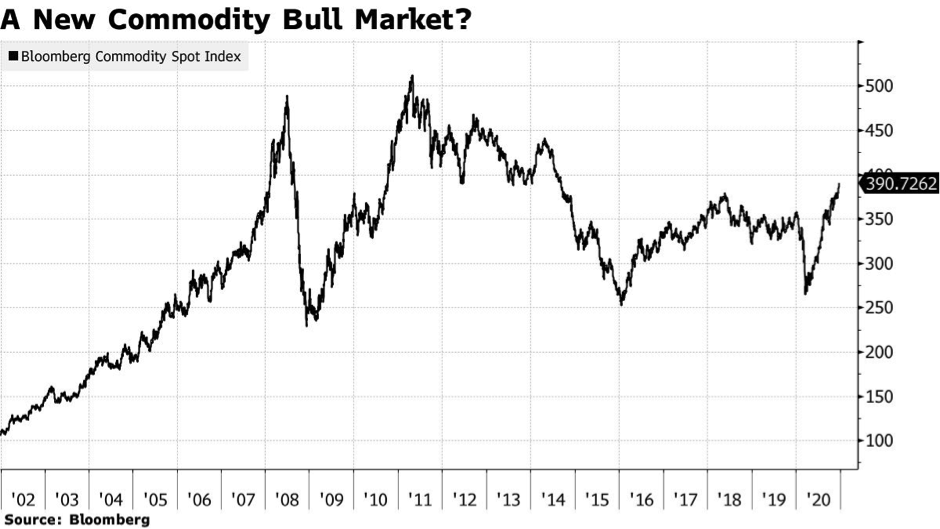

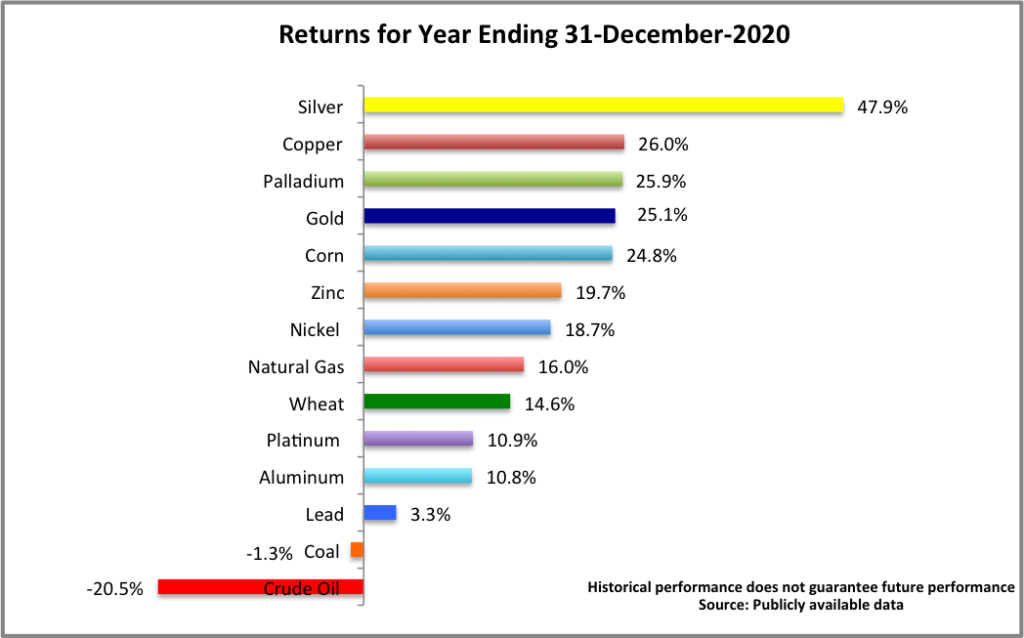

The tables turned for commodities during the second half of the year, with an across-the-board rally putting all but oil and coal prices in the black for the year. The steep climb in most commodity prices from their March nadir has given rise to predictions that this may be the start of a commodity boom after almost an entire decade during which the sector has been out of favour.

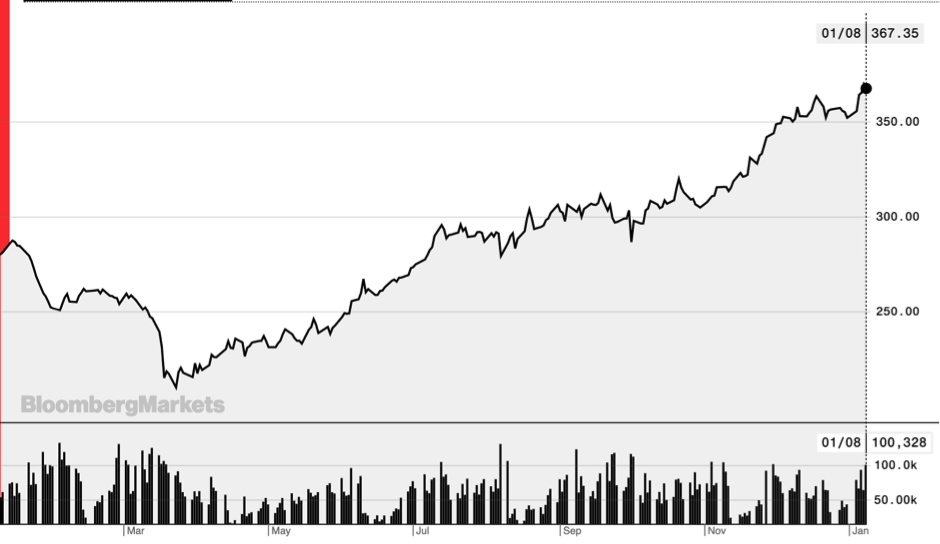

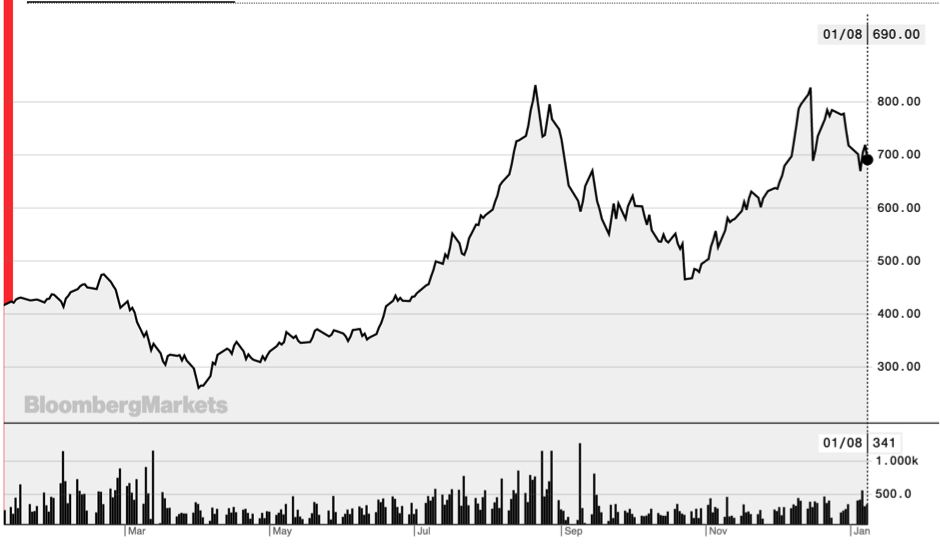

Precious metals retained their half-year lead in 2020 but silver prices overtook gold prices to become the biggest winner, gaining almost 50%, for the year. Although gold broke through the $2 000 an ounce level in August, it retraced to below $1 800 by late November and picked up again towards the end of the year, leaving it a still-healthy 25% higher for the year a whole.

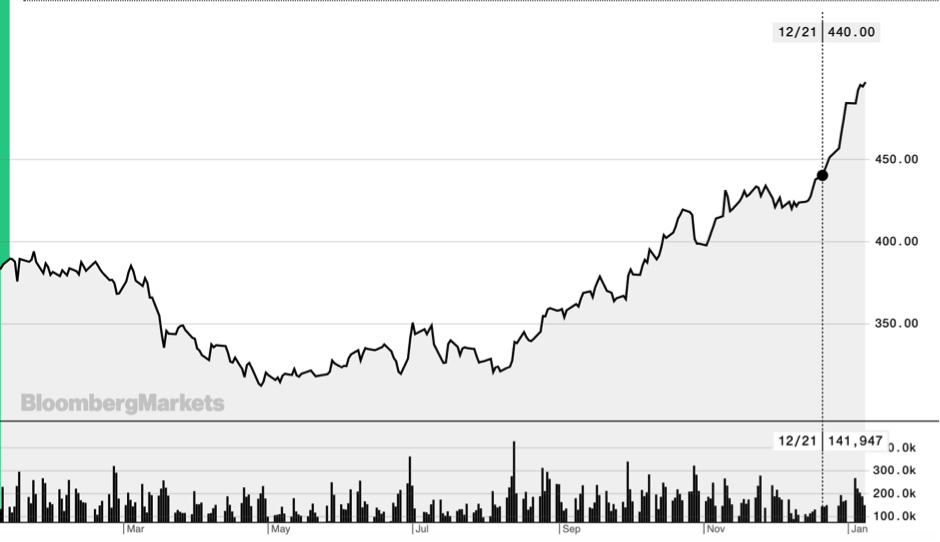

Other 25%-plus winners for the year were copper and palladium, both benefiting from their places in a shift towards renewable alternatives. Soft commodities, mainly soybeans and corn, also were lifted on a rising tide created by supply shortages and burgeoning Chinese demand.

Crude oil managed to win background after US WTI crude oil went negative at one point during the first half of the year in response to traders desperate to offload their soon-to-be maturing contracts. Brent crude oil spent most of the second half of the year trading around $45 a barrel buoyed by the OPEC+ agreement on another production cut in April. In early 2021, the price broke above the $50 a barrel level for the first time since its steep March sell-off.

Market conditions conducive to a bull-case scenario for commodity prices during the year ahead would entail a mostly trouble-free roll out of vaccinations in the developed markets, with herd immunity achieved this year, and a resultant economic rebound in the second half of 2021. Signs of inflation returning would likely propel the rise as investors take advantage of the reflation trade that came into play in earnest at the start of 2021.

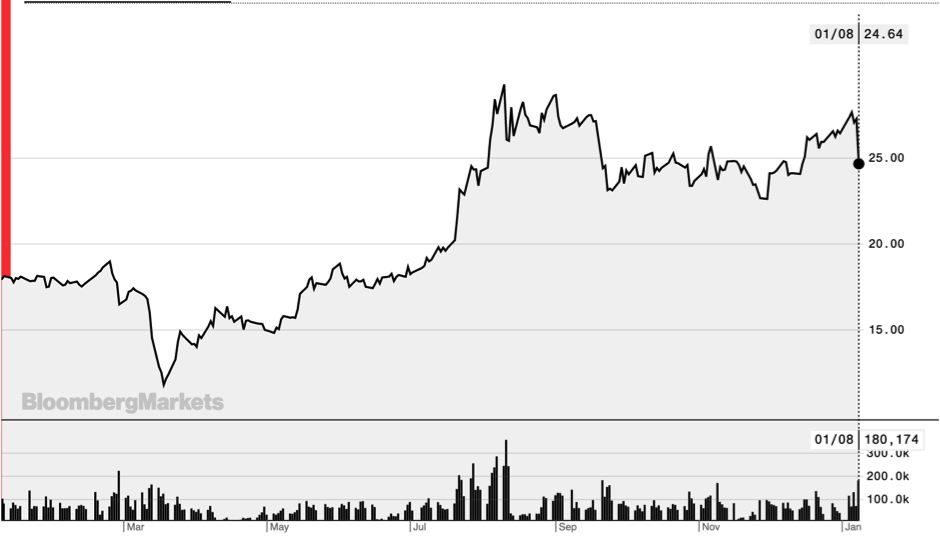

Precious metals

Silver led the leader board in the precious metals space, seeing strong demand arise from its dual role as an industrial metal used in solar panels, as well as a safe-haven investment. The price of silver climbed to $30 in August, 67% higher than its $18 level at the beginning of the year. Towards year end it fell back to about $25 as optimism based on the emergency approval of two promising vaccines, develop by Pfizer BioNtech and Moderna, reintroduced the prospect of an economic rebound during 2021.

Silver spot price ($/oz)

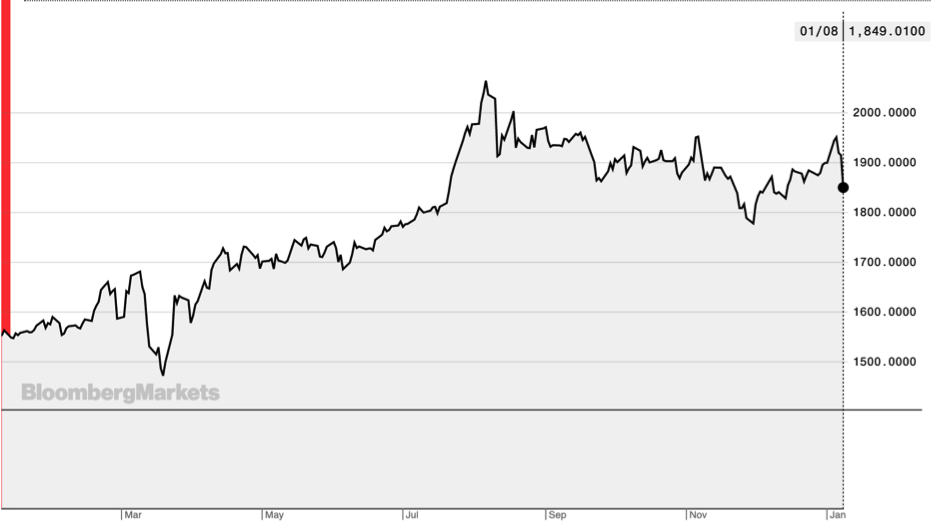

The movements in gold price were perplexing at some stages during the second half of the year. Given its position as the world’s go-to safe-haven asset, it was expected that there would be a sooner and greater advance with a second wave of Covid-19 infections taking hold. The spot price did belatedly, and significantly, break through the $2 000 level in August as infections and death rates continued spiralling into the year-end. The precious metal entered the New Year trading below $1 900 as vaccines began to be rolled out in the key developed markets.

Gold spot price ($/oz)

Palladium was the second-best performer in the precious metal basket and third-best performing commodity overall, benefiting from its role in neutralizing engine emissions in the auto industry and the years of undersupply, which saw it reach a record high of $2 875.50 in February. The outlook for the metal looks promising in 2021, with a return to growth in the global economy and rising auto sales, along with ongoing supply constraints and a Biden-administration’s renewed push for clean energy, providing tailwinds for the metal’s price.

Base metals ride out the pandemic storm

The second-best performing commodity last year, copper was lifted by China’s early recovery from the pandemic and massive stimulus programs focused on infrastructure investments. The metal benefits from its position as a core component in electronic and alternative energy equipment, propped up by the ongoing shift towards a low-carbon future.

After hitting a low in March, copper price has rallied a substantial 67% off its low to trade above $350 an ounce in early December. The base metal continued to rally into 2021, reaching $365.35 at the start of the second week of the new year. Prospects for the metal’s price will be tied to China’s economic fortunes and whether stimulus measures continue to remain in place for some time to come.

Copper (COMEX)

The trajectory of iron ore also followed the China story in 2020. The steelmaking metal’s outlook is also likely to be determined by the extent of the stimulus maintained in the world’s second-largest economy. Iron ore’s rally from its low in March was even more significant than copper’s, with benchmark 62% iron ore for delivery to north China increasing almost 90% from its $79.60 March low. Iron ore has benefited from both supply issues in number two exporter Brazil and strong demand from China, which buys more than two-thirds of seaborne cargoes.

Other base metals, aluminium, nickel and zinc, also had positive year due to China, the biggest consumer of these metals, going on a buying spree.

Crude oil

Crude oil saw already lacklustre demand come to a sudden stop as the global economy went into shut down as the pandemic took hold in the second quarter of last year. Still, the price managed to claw back some of its losses, steadily gaining some ground in the second half of the year. For the as a whole, however, the price of crude oil remained deep in the red, shedding 20% of its value – the worst-performing commodity in 2021.

The price of crude oil was also hit by the OPEC+ grouping’s inability to initially agree on production cuts but then deepened supply cuts at its April meeting. Towards the end of the year, the organization agreed to maintain production cuts into 2021. At its first meeting in January, OPEC and Russian again agreed to roll over production cuts after Russia threatened to walk away from the table. West Texas Intermediate oil price shot above $50 a barrel on the news.

The group of major oil producers acknowledged the pandemic’s unprecedented conditions and commended members for carrying out the most extensive and longest crude oil supply cut in history.

Saudi Arabia agreed to cut its production by one million barrels per day, while Russia and Kazakhstan will produce more oil over the coming months.

Although longer-term prospects for the commodity remain unfavourable as the world shifts towards renewable alternatives, during 2021, crude oil price should benefit from likely tighter supplies and more robust demand as mobility resumes worldwide.

WTI Crude Oil

Natural Gas

Natural gas prices were volatile in the second half of the year after coming under significant pressure in the first half. Henry Hub averaged $2.05 per million British thermal units (MMBtu) during 2020 – its lowest annual average price in decades. A mild winter going into 2020 and the pandemic’s economic effects all served to weigh on natural gas prices in the first half and then as lockdowns were eased in the second half gas prices experienced a vigorous rebound.

Nymex gas price climbed to a high of well over $3 before settling down to just above $2.50 by the end of the year. Contributing to the better industry fortunes was a hot summer increasing demand for air conditioning and lower US output due to curtailed growth in share oil production. As a result of the second half pick up, natural gas prices managed to rise by 16% for the year as a whole – its best annual performance since 2016.

Natural Gas (Nymex)

Lumber

Strong building demand saw US lumber prices soar to levels never seen before in the third quarter of 2020. Southern pine prices increased 160% from their April low to September, and Douglas-fir prices almost doubled over the same period. The price surge in the US domestic market directly impacted Canadian export prices, with average prices for US-bound lumber 94% higher in September 2020 than the previous year.

Lumber prices were mainly buoyed by unexpected demand from home renovations and building during the pandemic lockdowns and low inventories in the wake of production cuts in the second quarter. US single-family home construction in 2020 reached its highest level since 2007 and is expected to continue rising during 2021. Kevin Lee, chief executive officer of Canadian Home Builders’ Association, does not see the higher cost impacting the number of homes being built at current levels.

Lumber (CME)

Soft commodity prices undermined by tense US-China relations

Soybeans and grains rallied to more than six-year highs during 2020 as unfavourable weather conditions in South America and Europe adversely affected yields and Chinese demand soared as it bought farm goods in an attempt to meet the phase 1 trade agreement of its trade deal with the US. Some view current price levels as underpriced given supply constraints. As a result, soybean prices extended their gains in early January.

Soybeans – CBOT

Corn supplies may not be as tight as soybeans. Still, prices are expected to continue to benefit from the bullish optimism spurring soybean prices and farmer protests and dry weather in South America may further limit corn supplies. The US Department of Agriculture is expected to reduce its domestic corn stock outlook in its January 12 crop report. If so, corn prices could be supported at just short of $4.90 a bushel versus an average closing price of $3.64 per bushel in 2020.

Garnet O. Powell, MBA, CFA is the President & CEO of Allvista Investment Management Inc., a firm with a dedicated team of investment professionals that manage investment portfolios on behalf of individuals, corporations, and trusts to help them reach their investment goals. He has more than 20 years of experience in the financial markets and investing. He is also the Editor-in-Chief of the Canadian Wealth Advisors Network (CWAN) magazine. He can be reached at gpowell@allvista.ca