Tale of Two Markets: Precious Metals Soar as Agriculture and Energy Lag

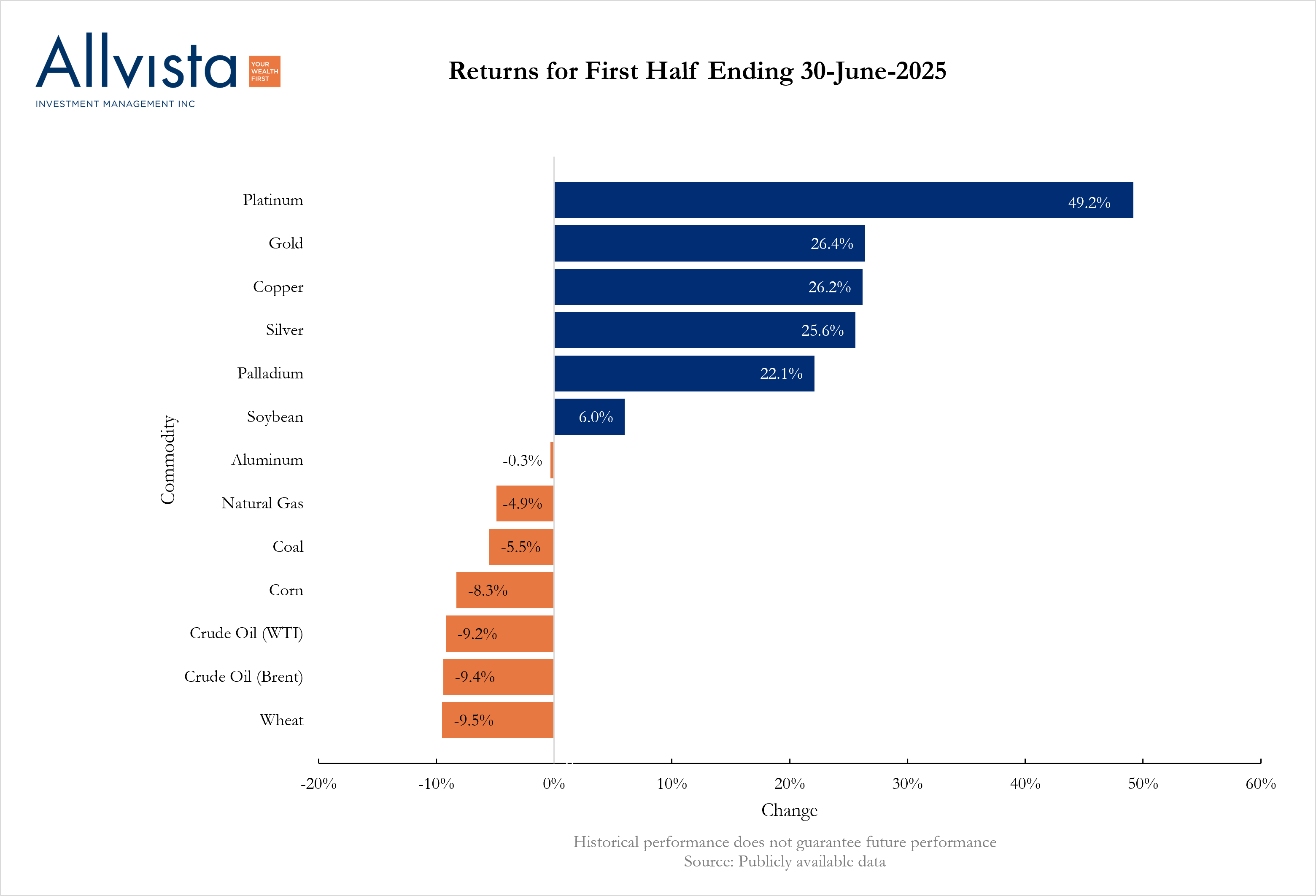

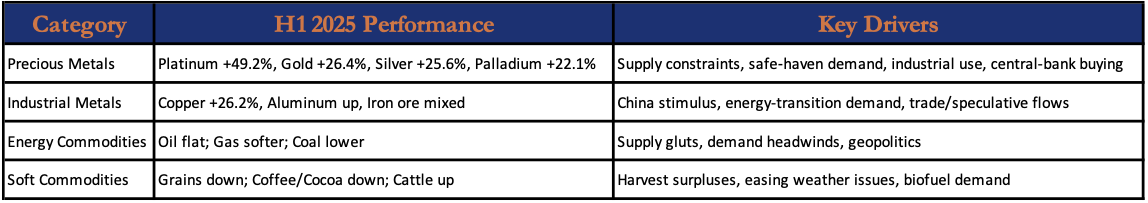

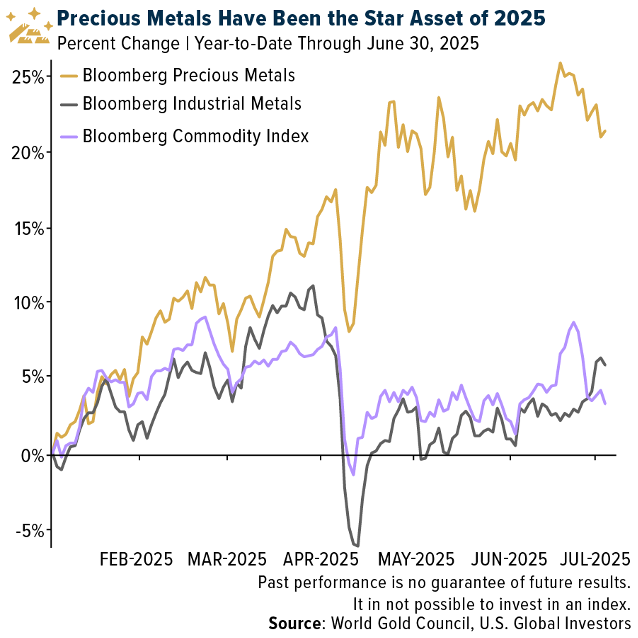

The first half of 2025 delivered a tale of two markets across the commodity complex, with precious metals and base metals surging while energy and agricultural commodities faced significant headwinds. Against a backdrop of escalating trade tensions, Middle Eastern conflicts, and shifting monetary policy expectations, commodity performance ranged from platinum’s spectacular 49.2% gain to wheat’s 9.5% decline.

Futures price change

Macroeconomic Context

The period was defined by unprecedented market volatility driven by President Trump’s aggressive trade policies and geopolitical tensions in the Middle East. The April 2nd “liberation day” tariff announcement triggered a sharp market selloff, with the S&P 500 falling 12% in a single week. However, a subsequent 90-day pause on reciprocal tariffs and progress on a China trade deal helped restore investor confidence, leading to a strong recovery in risk assets.

Shifting monetary policy expectations in the US meant that the US Federal Reserve had to balance the prospect of potential tariff-induced inflation while supporting an economy in which trade disruptions could slow growth. Meanwhile, other developed market central banks (the ECB, BOE and the Bank of Canada) each cut their interest rates twice this year.

The weakening US dollar, down 7.1% in the second quarter alone, provided additional support for dollar-denominated commodities. Meanwhile, the 12-day Iran-Israel conflict, while causing significant geopolitical anxiety, ultimately had a limited lasting impact on commodity markets as fears of supply disruptions proved unfounded.

Top Performers: Metals Lead the Charge

Platinum (+49.2%): The Standout Performer

Platinum emerged as the period’s most spectacular winner, delivering its strongest half-year performance in over a decade. The metal’s extraordinary rally was driven by a convergence of supply-side constraints and recovering industrial demand. South African production disruptions, which account for approximately 70% of global platinum supply, created persistent supply tightness throughout the period.

The automotive sector’s recovery played a crucial role, with renewed optimism about internal combustion engine demand supporting platinum’s use in catalytic converters. Additionally, industrial applications in chemical processing and petroleum refining provided steady demand growth. Investment flows surged as institutional investors recognized platinum’s relative undervaluation compared to gold and palladium, triggering momentum buying that accelerated the rally into the second quarter.

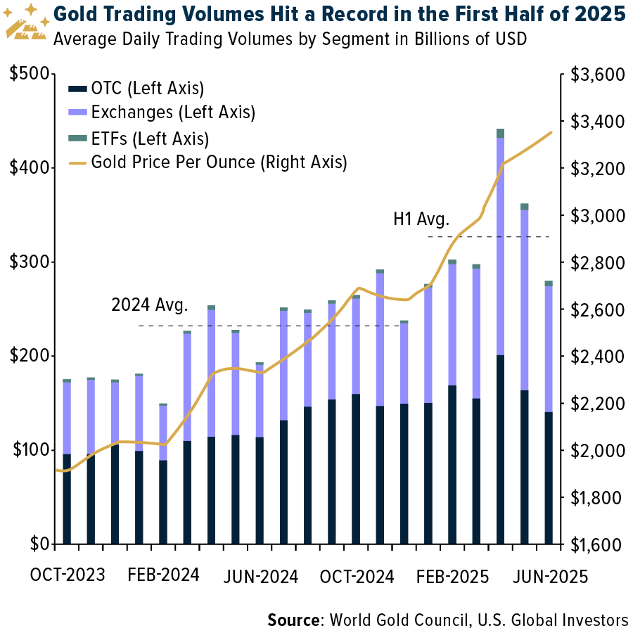

Gold (+26.4%): Safe Haven in Turbulent Times

Gold maintained its traditional safe-haven appeal amid geopolitical uncertainty and growing concerns over US fiscal sustainability. The metal’s performance was particularly strong during the April tariff crisis, when investors fled risk assets for the security of precious metals. Central bank buying, while moderating from previous years, remained supportive throughout the period.

However, recent data suggests the rally may be losing momentum. ETF flows slowed significantly into the end of June, with early indications that central bank purchases are following a similar pattern. The precious metal showed little reaction to the Israel-Iran conflict, suggesting speculative positioning had reached elevated levels. Analysts now expect gold to consolidate around the $3,100-$3,500 range, with the April highs around $3,500 potentially representing a near-term peak as household holdings reach record levels.

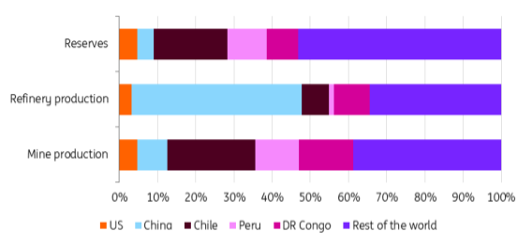

Copper (+26.2%): US Tariffs Triggers Split in US and Global Markets

Copper experienced extraordinary volatility, creating one of the most dramatic market distortions of the period. The metal’s performance was fundamentally split between US and global markets following Trump’s surprise announcement of a 50% tariff on copper imports, effective August 1st.

The tariff announcement triggered the largest single-day price increase in records dating back to 1968, with COMEX futures surging 17% and creating a 25% premium over London Metal Exchange prices. This massive arbitrage opportunity led to a rush of copper flowing into the US, with Comex warehouse inventories more than doubling in the second quarter to levels not seen since 2018.

The front-loading of demand created artificial tightness that supported prices around $10,000 per ton, but analysts warn this could reverse sharply once tariffs are implemented. The US imports approximately 850,000 tonnes of copper annually, representing 50% of domestic consumption, with Chile providing 40% of these imports. The lengthy process of developing new US mines—averaging 29 years due to permitting requirements—means domestic production is unlikely to respond quickly to tariff protection.

The US produces around 5% of global copper mining output

Source: USGS, ING Research

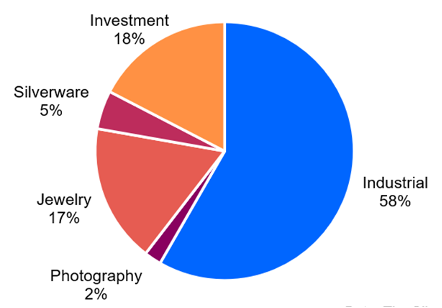

Silver (+25.6%): Industrial Demand Drives Performance

Silver’s impressive 25.6% performance was underpinned by a unique combination of safe-haven demand and robust industrial consumption. Unlike gold, approximately 80% of silver demand comes from industrial applications, with solar panel manufacturing providing particular strength throughout the period.

Silver demand by source, according to the Silver Institute 2024

The metal’s rally accelerated in June, rising 12% as industrial demand remained resilient despite concerns about renewable energy policy changes. Solar sector consumption continued growing, while electronics and cutlery demand held steady. The surge prompted Americans to empty jewellery boxes and coin jars, with coin dealers reporting significant increases in selling activity as the metal reached levels not seen since 2011.

Investment demand also surged, with the iShares Silver Trust adding nearly 11 million ounces to keep pace with demand. The combination of industrial strength and investment flows created a powerful bull market that analysts believe could continue despite the risk of substitution at higher price levels.

Palladium (+22.1%): Automotive Recovery and Renewed Investor Interest

Palladium’s strong 22.1% rebound reflected recovering automotive production and renewed investor interest in the platinum group metals complex. The metal benefited from improved sentiment toward internal combustion engines and steady industrial demand. After underperforming in previous periods, palladium attracted renewed institutional interest as investors recognized its oversold condition relative to other precious metals.

Mixed Performance: Balanced Markets

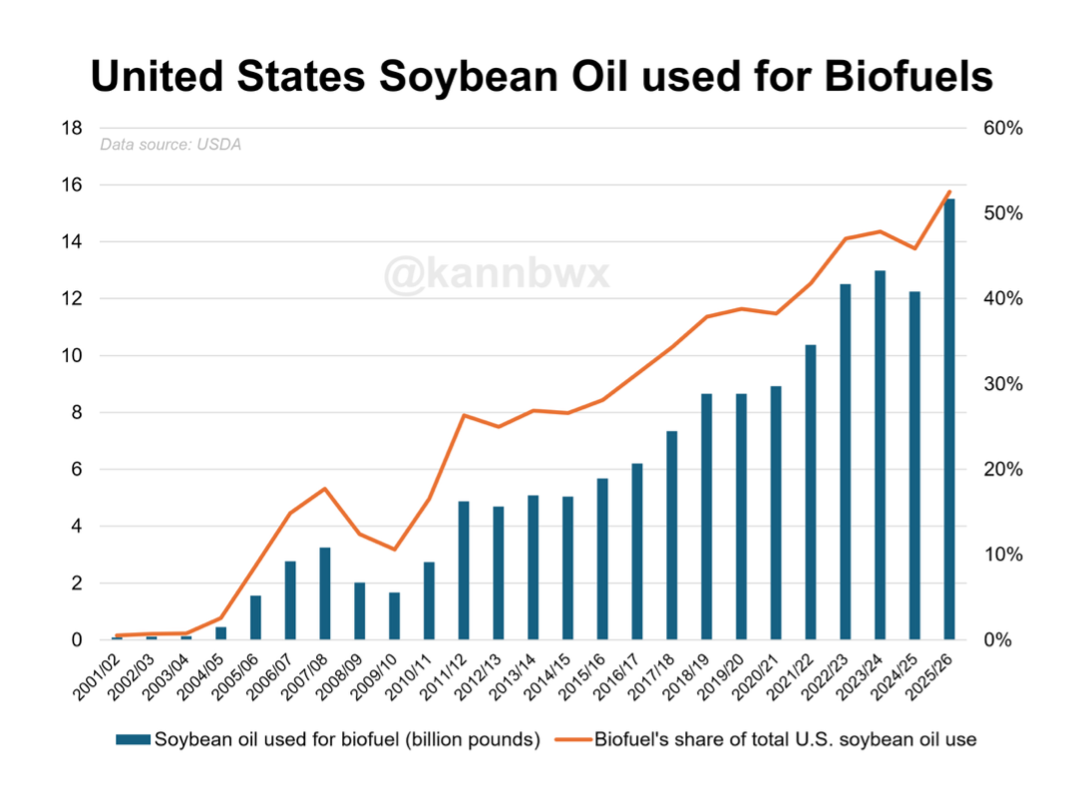

Soybeans (+2.6%): Biodiesel Demand Provides Support

Soybeans managed modest gains of 2.6% despite broader agricultural weakness, primarily supported by a dramatic surge in biodiesel demand that fundamentally transformed the sector. The EPA’s proposal to substantially raise renewable diesel targets for 2026 created expectations of explosive growth in biodiesel consumption, with soybean oil emerging as the primary beneficiary.

The scale of this demand shift was unprecedented. According to the USDA’s July supply-and-demand report, US biofuel makers are projected to consume more than half of all soybean oil produced domestically in 2025/26 marketing year – a record 15.5 billion pounds, representing an 11.5% increase from the previous month’s forecast and 26.5% higher than the current marketing year.

This surge in domestic biofuel consumption is expected to dramatically reduce US soy oil exports, which are forecast to fall to just 700 million pounds in 2025/26 from 2.6 billion pounds in the current season. The policy changes creating this shift were multifaceted: the EPA not only significantly raised blending mandates but also proposed reducing Renewable Identification Numbers (RINs) for imported renewable fuels and those produced from foreign feedstocks starting in 2026.

This policy-driven demand surge provided crucial support for soybean oil prices, which firmed throughout the period and hovered near seven-and-a-half-month peaks by late June. The strength in soy oil prices, in turn, lifted the entire soybean complex despite otherwise bearish fundamentals in agricultural markets. However, crop expectations and trade dynamics with China remained mixed, limiting the upside potential beyond the biodiesel-driven demand growth.

Aluminum (-0.3%): Decarbonization Demand Balances Weak Seasonal Demand

Aluminum remained essentially flat throughout the period, reflecting broadly balanced market fundamentals. The metal faced seasonal demand weakness in China, the world’s largest producer and consumer, as industrial activity typically slows during summer months. However, strong decarbonization-driven demand from renewable energy and electric vehicle sectors provided medium-term support.

Energy costs, a critical factor for aluminum production, remained manageable despite periodic oil price spikes. The market also benefited from ongoing supply discipline among major producers, preventing the oversupply conditions that have plagued the industry in previous cycles.

Energy Sector Struggles

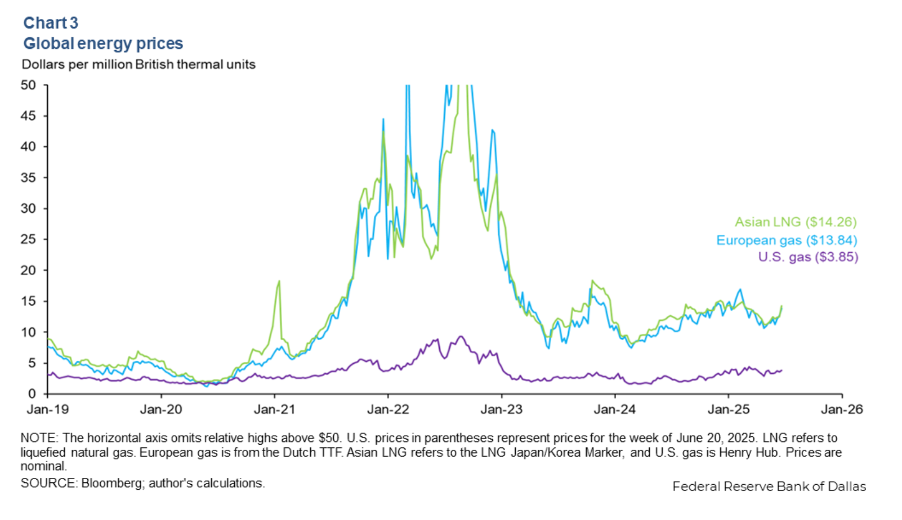

Natural Gas (-4.9%): Supply Abundance Amid Geopolitical Tensions

Natural gas faced persistent headwinds from storage surpluses and relatively mild weather conditions across key consuming regions, despite the complex geopolitical backdrop that historically would have supported prices. The commodity’s 4.9% decline in the first half of 2025 masked significant regional variations and structural changes in global gas markets.

The Energy Information Administration reported US storage levels at over 3 trillion cubic feet, up 6.1% from the five-year average, though still down 5.8% year-on-year. This storage abundance, combined with record-high US production levels despite subdued drilling activity, created downward pressure on prices. Technological advancements and efficiency gains in shale gas extraction enabled the US to maintain its position as the world’s top LNG exporter while meeting robust domestic demand from industrial use and power generation.

European TTF natural gas prices showed greater stability following the de-escalation of Middle Eastern tensions, though the region faced a fundamental transformation in its supply dynamics. Russia’s declining natural gas production, largely due to sanctions and reduced pipeline exports to Europe, forced European nations to pivot toward LNG imports at near-record levels, primarily from the US, Qatar, and Africa. This transition reshaped Europe’s energy infrastructure, with new regasification terminals and storage facilities being rapidly developed.

China’s natural gas demand softened due to slower economic growth and increased competition for LNG cargoes from Europe. The country is diversifying its energy mix toward renewables and coal, reducing its reliance on imported gas.

Despite structural changes and geopolitical risks, abundant supply and mild weather conditions ultimately outweighed support factors, keeping natural gas prices under pressure throughout the first half of 2025.

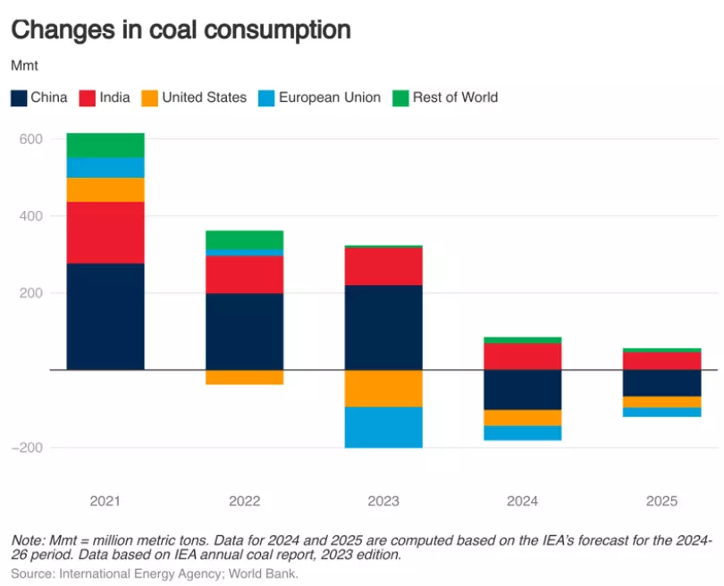

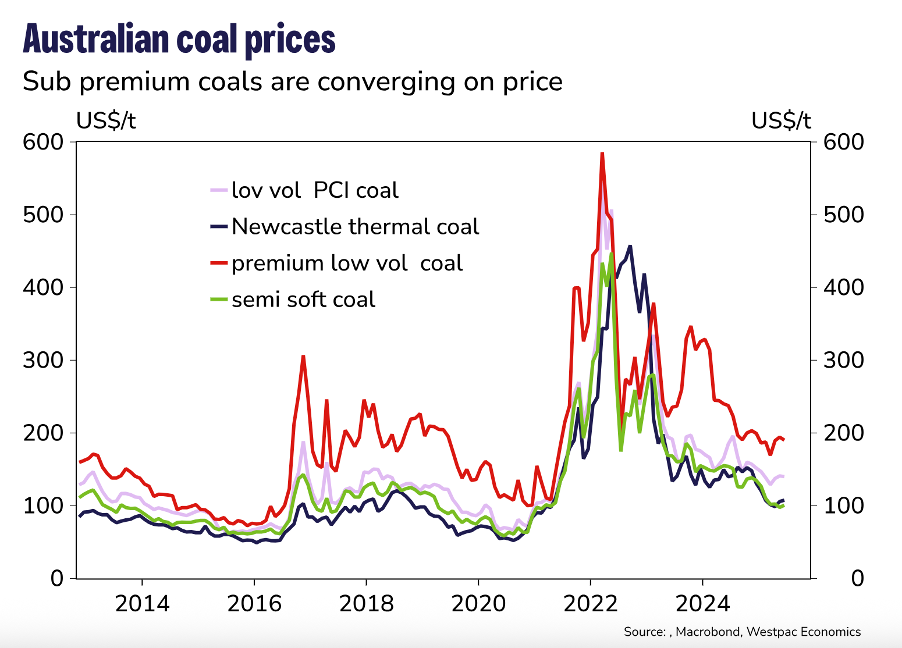

Coal (-5.5%): ESG Pressure Amid Supply Disruptions Weighs on Sentiment

Coal faced a challenging environment characterized by both demand moderation and increasing ESG-related pressure from institutional investors. However, supply disruptions provided some price support, with thermal coal showing surprising resilience in certain markets despite the overall negative sentiment.

The global coal market was significantly influenced by China’s domestic production surge, which rose 5% year-on-year in the first half of 2025 to 2.4 billion tons. This substantial increase in Chinese output created oversupply conditions as authorities focused on ensuring a sufficient domestic supply while buyers switched from imports to cheaper domestic coal. June production alone reached 421 million tons, up 3% from the previous year.

This shift in Chinese supply dynamics created downward pressure on global coal prices, with domestic Chinese coal prices languishing at four-year lows since February. The market watched closely for potential output reductions from Chinese mining regions to alleviate the current oversupply.

Australian premium hard coking coal demonstrated unexpected strength despite these headwinds, with prices rising approximately 11% during periods of supply tightness. Indian steel mills largely restocked during the period, providing short-term support, though demand was expected to slow as both China and India entered their off-season. The divergence between thermal and coking coal performance highlighted the different supply-demand dynamics across coal types.

Agricultural Commodities Face Headwinds

Corn (-8.3%): Abundant Supply Pressures Trigger Hefty Price Declines

Corn suffered one of the largest declines in the commodity complex, sliding 8.3% on expectations of strong harvest projections and weak feed demand. Brazil’s agriculture agency CONAB significantly raised corn production estimates for the 2024/25 season to 132 million tons, up from 128.3 million tons previously forecast and well above the 115.5 million tons produced in 2023/24.

Strong Brazilian supply, combined with expectations for a robust US corn crop, created overwhelming supply pressures that outweighed any support from ethanol demand. CBOT corn prices fell more than 11% year-to-date, reflecting the market’s assessment of abundant global supplies and weakening demand fundamentals.

Wheat (-9.5%): Global Supply-Demand Imbalance Creates Bearish Backdrop

Wheat declined sharply by 9.5% despite periodic support from weather concerns in major producing regions. Improved US crop outlooks and increased EU production weighed heavily on prices throughout the period, creating a bearish supply backdrop.

However, the market faced competing forces, with Russian export quotas and South American weather risks providing some support. Dry conditions in key producing regions, including the US, Russia, and France, created periodic price spikes, but these were ultimately overwhelmed by the broader supply abundance.

The global wheat market remained under pressure from structural oversupply, with forecasts pointing to continued weakness as harvest season approached. Australian grain markets faced particularly complex dynamics, with domestic prices trading above export parity and growing divides between regional supply conditions.

Oil’s Disappointing Performance

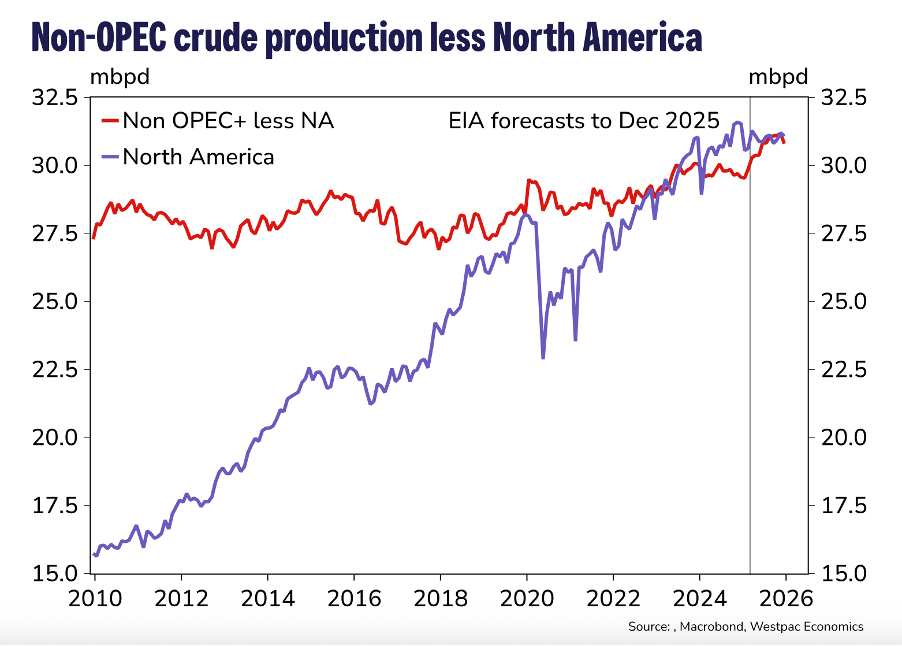

WTI (-9.2%) and Brent (-9.4%): Demand Concerns Override Geopolitical Tensions

Both WTI and Brent crude suffered significant declines of 9.2% and 9.4% respectively in the first half of the year, despite periodic geopolitical tensions that historically would have supported prices. Concerns about the market’s ability to absorb additional OPEC+ supply increases, against a backdrop of slowing global demand, kept prices under sustained pressure.

Brent crude reached $80 per barrel during the height of Middle Eastern tensions, driven by fears of a potential Strait of Hormuz blockade. However, the market quickly reassessed these risks, with prices falling over 7% in a single day as de-escalation became apparent. The subsequent peace proposal between Iran and Israel triggered another 6% decline, with prices stabilizing at around $67 per barrel.

The oil market faced a challenging fundamental backdrop, with OPEC+ reportedly nearing the end of its supply hikes after potentially one more increase for September. These increases are expected to push the global oil market into a large surplus in the fourth quarter, intensifying downward pressure on prices despite the current relative tightness during the northern hemisphere summer.

US crude inventories showed mixed signals, with the API reporting hefty builds that suggested weakening demand. The permanent loss of Venezuelan crude and the temporary loss of Canadian supplies provided some support, but this was insufficient to offset broader demand concerns.

Looking Ahead: Second Half Outlook Dependent on Macroeconomic Outcomes

Trade policy seems likely to remain the dominant commodity-market theme across multiple sectors during the second half of 2025. Copper tariffs are set to create significant market distortions, with the artificial tightness in US markets likely to reverse once tariffs are implemented on August 1st, potentially triggering sharp price corrections.

As the OPEC+ supply increases, the global oil market will likely experience a large surplus in the fourth quarter. Thus, energy markets face a challenging period. The approaching end of peak summer demand season will likely intensify downward pressure on prices, with Brent potentially falling back toward $60 per barrel by year-end.

Agricultural commodities may find support from weather concerns, particularly for grains, where dry conditions in key producing regions could limit supply. However, abundant global supplies will likely cap any significant rallies.

The key themes for the remainder of the year will be whether macroeconomic trends, including rate expectations and geopolitical developments, continue to dominate commodity-specific fundamentals, and how markets adapt to the new trade policy reality under the Trump administration.

Conclusion

The first half of 2025 demonstrated the increasing importance of policy decisions over traditional supply-demand fundamentals in driving commodity prices. While metals benefited from both safe-haven demand and policy-driven supply concerns, energy and agricultural commodities struggled with abundant supplies and demand concerns. The second half will likely see a reversal of some of these trends as policy effects work their way through the system and seasonal factors reassert their influence.

Garnet O. Powell, MBA, CFA is the President & CEO of Allvista Investment Management Inc., a firm with a dedicated team of investment professionals that manage investment portfolios on behalf of individuals, corporations, and trusts to help them reach their investment goals. He has more than 25 years of experience in the financial markets and investing. He is also the Editor-in-Chief of the Canadian Wealth Advisors Network (CWAN) magazine. He can be reached at gpowell@allvista.ca